¶ Default Fees

These can be configured & triggered in various ways.

For PremFina Funded, a “default” fee is added automatically along with the representation of an instalment, if the original instalment failed to get collected in the first instance via Direct Debit.

Apart from certain selected reasons (e.g. death), the default fees (based on Personal lines or Commercial lines) are automatically triggered by the system along with the relevant notification via email and SMS.

Note: The default fees must be paid off to clear the arrears on the system. Without this, the agreement may be passed on to the debt collection agencies

¶ Facility Fees

When a quote is created, the calculator service checks whether a Facility Fee is applicable and should be applied. This is checked by a call being made to our internal facility fees microservice.

The response from the microservice will tell if a fee should be applied to this quote, and what the value of the fee should be.

If a Facility Fee is applicable, then this will be added in the quotation response.

If an agreement is created where a fee applies, then this will be added to the agreement. This will cause the first instalment to include the Facility Fee. I.e. The “Facility Fee” is collected along with the first instalment.

¶ Minimum Credit Charges

¶ Introduction

MCC (Minimum Credit Charge) is a value which can be set on a finance provider scheme. This value determines the minimum charge that will be applied to the loan. The charge on the loan would usually be defined by the added interest.

For example, if a loan of £400 is created and the rate is 10% then the added charge is £40. If an MCC were set on this scheme as £50, then the charge being applied would need to be replaced with £50 in this scenario above. The way the charge is overridden is by automatically amending the rate on the agreement to increase the interest charge to the desired value. This should be apparent from the below examples.

¶ Configuration

On the PremFina Portal, Administrators will have access to the “Maintain Schemes” page. This is where scheme specific configurations are set. On each scheme, the following values can be set regarding MCC:

- “Minimum Credit Charge” sets the value for the MCC.

- “MCC Active” allows the MCC to be turned off and on.

¶ Quotation - Portal

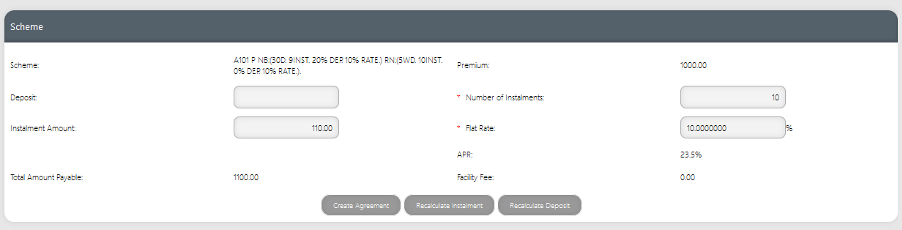

In this example, on this scheme the MCC is set at £50; and the scheme rate by default is set to 10%.

When requesting a quote with an advance of £1000, the interest would be £100. This already meets the MCC value of £50; therefore there is no replacement of charges.

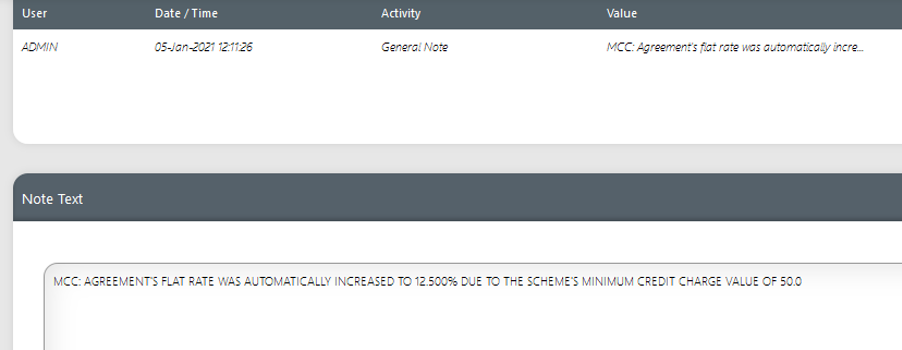

When requesting a quote for £400, the added charge would be £40 (10%). However, this does not meet the MCC value of £50; and therefore, there is a notice (see below):

A note will also be added into the “events and notes” section to describe what happened

¶ Quotation - API

In this example, on this scheme the MCC is set at £50; and the scheme rate by default is set to 12%.

An example request for the quotation endpoint can be seen below.

Request - Sample

POST /get/quote/

{

"schemeCode" : "TES001",

"deposit" : "0",

"premium" : "1000",

"startDate" : "2020-02-05"

}

Response - Sample

The scheme flat rate by default is 12%. Therefore, the normal charge to be applied would be 1000 x 0.12 = £120. In this instance, because the MCC is £50, the minimum credit charge is aready met (i.e. MCC rule is NOT Triggered).

Relevant fields in response:

"minimumCreditChargeActive": true,

"minimumCreditCharge": 50,

"minimumCreditChargeMet": true,

"loanAdvance": 1000.00,

"loanInterest": "120",

Request - Sample

POST /get/quote/

{

"schemeCode" : "TES001",

"deposit" : "0",

"premium" : "300",

"startDate" : "2020-02-05"

}

Response - Sample

The scheme flat rate by default is 12%. Therefore, the normal charge to be applied would be 300 x 0.12 = £36. In this instance, because the MCC is £50, the charge needs to be overridden to make it to £50 (i.e. MCC rule is Triggered).

Relevant fields in response:

"minimumCreditChargeActive": true,

"minimumCreditCharge": 50,

"minimumCreditChargeMet": false,

"loanAdvance": 300.00,

"loanInterest": "50",