¶  Overview of PremFina Platform

Overview of PremFina Platform

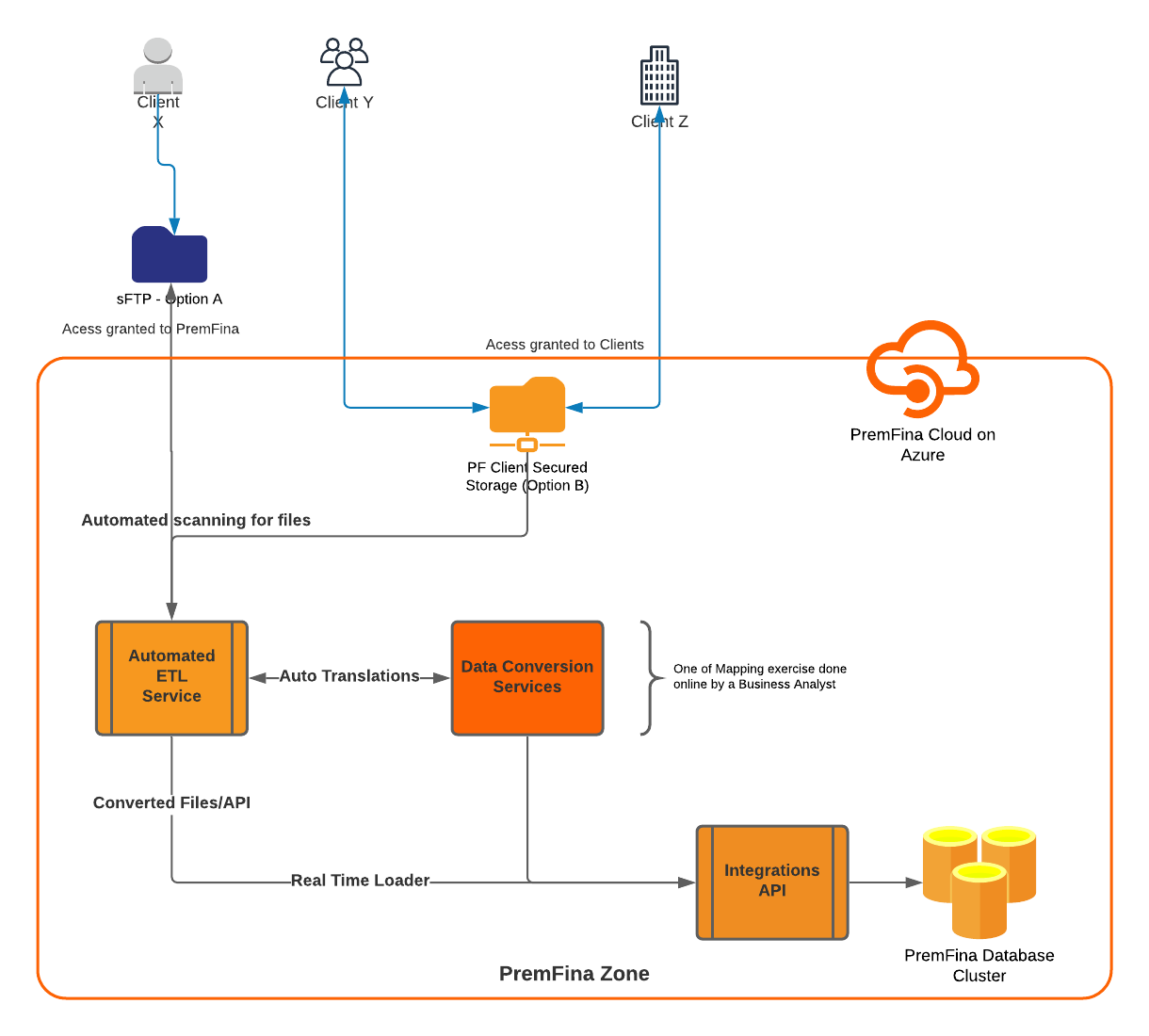

PremFina platform comprises of several microservices; and is built on the concept of open architecture with API first approach. Although, we prefer real-time integrations using our Restful-APIs, we understand that not all systems (especially the traditional ones) have easy integration capabilities. Because of this, we have built a data conversion tool which allows our clients to integrate very easily in Batch processing and have a near real time experience.

| PremFina Service | Integration | Format | Style |

|---|---|---|---|

| Integrations-Api | Real Time (Restful) | JSON | Preferred |

| Data Conversion Service | Batch - File based | csv, xml | Traditional |

| Broker Portal | Real Time | Web interface | Direct Input |

¶ 🏁 Getting Started

¶ 🗎 Planning your integrations specification document

Please note that this integrations specification structure is just a rough suggestion of what a typical integrations specification document should contain. We have kept it simple to the very minimum structure. Please feel free to develop yours as detailed and informative as possible.

🖧 Tell us about the system integrating with PremFina API

- Overview of the system/website/app integrating with PremFina API. [This can be information about the system, technology stack, customer or broker facing, frequency of transactions per seconds/minute/hour, any existing integrations]

🖧 Tell us about the user journey and flows

- Describe the new business user journey. [A flow chart might be useful to support the explanation]

- Describe the renewal user journey. [A flow chart might be useful to support the explanation]

- Describe the mid term adjustment user journey. [A flow chart might be useful to support the explanation]

- Describe the cancellation user journey. [A flow chart might be useful to support the explanation]

- Describe the user journey for updating customer details such as bank account, payment due date and contact details. [A flow chart might be useful to support the explanation]

- Describe the auto rec user journey. [A flow chart might be useful to support the explanation]

- Describe any other user journey that we should know about. [A flow chart might be useful to support the explanation]

🖧 Tell us about the integrations to the API

- What type of credit agreements would be created via the API? This can be personal or commercial lines or both.

- What endpoints would you use? [You can find some of our endpoints on the wiki as well as the Postman test collections]

- For each of the endpoints, what would the request look like? Also, what data would you be sending via the API? [This is because we do have a combination of mandatory and optional fields]

- For each of the endpoints, what data within the response would you consume? Also, what data would you be sending via the API? [This is so we know which datapoints are important to you]

- Would you be hardcoding any values? If yes, please specify the fields and the reasons for not making them variable/dynamic.

- Would you be doing any calculations locally? If yes, please specify which and the reasons for calculating values locally instead of consuming what we will send to you.

- Would you be storing a local copy of the data that you retrieve from PremFina API? If yes, please specify which and the reasons for storing a local copy of the data from our API.

- If you will be duplicating any data from PremFina by maintaining a local copy, please tell us about how you plan to ensure that the duplicated copy is kept up to date.

- On average and estimating, what is the volume of transactions for each business type (e.g. new business quotes, renewal quotes, new business, renewals, MTA, etc)?

🖧 Tell us about the security of the integrating system

- How would your users get authenticated? [This so we know how your access control mechanism works from your side]

- Would the data that you would be sending to us be encrypted? If yes, what standards?

- Would the data that you would be retrieving from us be encrypted? If yes, what standards?

- What is the TCP/IP in-bound traffic timeout duration for your network? [This is so we can handle potential timeouts properly]

- What is the TCP/IP out-bound traffic timeout duration for your network? [This is so we can handle potential timeouts properly]

- What static IP addresses would you be using for the Sandbox/UAT/Test system? [This is so we can whitelist the IP addresses to enable you gain access to our services]

- What static IP addresses would you be using for the Production/Live system? [This is so we can whitelist the IP addresses to enable you gain access to our services]

🖧 Tell us about your integrations project and timelines

- Tell us about the members of the project team

- Tell us about the contact details. For example, who do we reach out to for technical support queries, product queries, etc.

- What is the tentative UAT date? [A gantt chart might be useful]

- What is the tentative go live date? [A gantt chart might be useful]

- Any other details?

¶ 🖧 Connectivity

Currently, our security parameters are setup to authenticate and recognize external connections to our services in two ways.

🖧 Static IP Whitelisting

- The First Option: The first option is whitelisting of a static IP address(es). This means that you supply us a list of static IP addresses to whitelist. All the requests to our service must originate from that IP address or else they will be declined. Please note that the first option is not viable if you do not have a static IP address. This means that we cannot whitelist your personal IP address as you may work from home or office or anywhere and the ISP has a secure method of using a protocol called Dynamic Host Configuration Protocol (DHCP) to dynamically assign you an IP Address. This means that even if we whitelisted your current IP address, when you come to connect to our service, it would have changed and you would be using something that we do not recognise. This is the same for connecting to our Sandbox or Production environment. To proceed with this, please reach out to support@premfina.com with the IP addresses and the environment (Sandbox or Production) that you want to access.

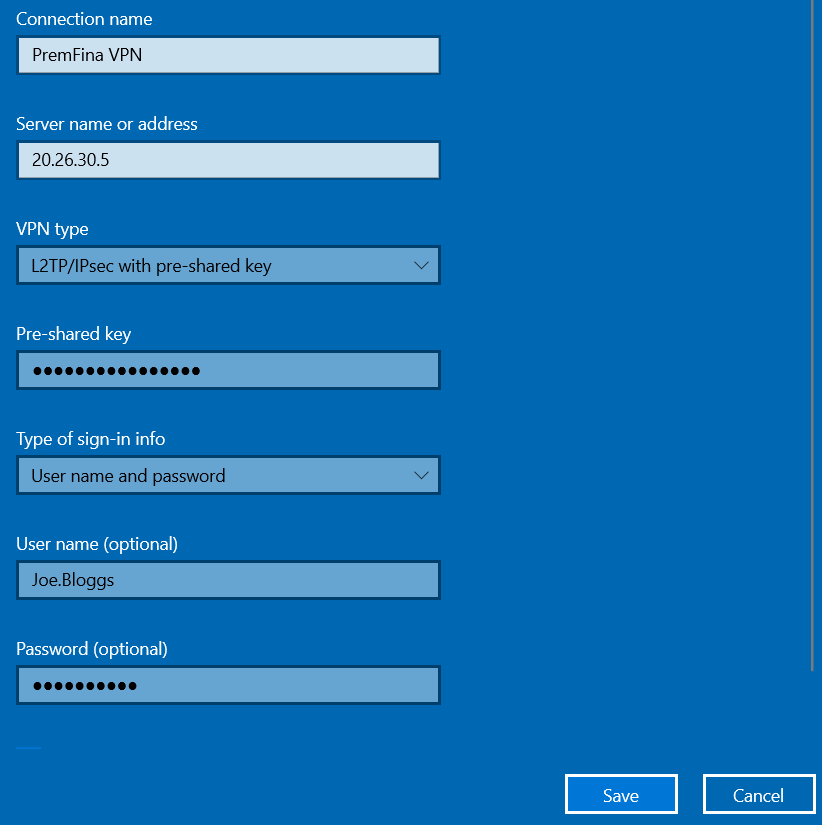

🖧 Virtual Private Network (VPN)

- The Second Option: The second option is using a PremFina VPN. Within this option, you request for a VPN, we create a VPN account for you and send you the Server name/address, VPN type, pre-sharedkey, type signin info, username and password. You use these details to connect to PremFina. This is the same for connecting to our Sandbox or Production environment. To proceed with this, please reach out to support@premfina.com with the IP addresses and the environment (Sandbox or Production) that you want to access.

¶  Access

Access

Please find the credentials to the API and Broker Portal in this section.

API Access For Sandbox (UAT Environment)

API_USER_CRA is the login to the entity ‘API CRA Broker’ which has CRA checks turned 'ON’. Therefore, you need to use our CRA test data which is supplied on this page.

- Primary URL*: https://integrations-api.sandbox.premfina.com/

- API Key Code**:

API_USER_CRA - API Secret:

LWcW0^A^r87u - Documentation ***: https://integrations-api.sandbox.premfina.com/documentation/index.html

API Access For Production Environment

-

API Key Code**:

Please request for one -

API Secret:

Please request for one -

Primary URL*: https://integrations-api-env-p.premfina.com/

-

Documentation **: https://integrations-api-env-p.premfina.com/documentation/index.html

Broker Portal Access For Sandbox (UAT Environment)

API_USER_CRA is the login to the entity ‘API CRA Broker’ which has CRA checks turned 'ON’. Therefore, you need to use our CRA test data which is supplied on this page.

- Primary URL: https://brokerportal.sandbox.premfina.com/

- Username: PORTAL_USER

- Password: RhVMZZzC2Fod7erLikMd

Broker Portal Access For Production Environment

- Primary URL: https://portal.premfina.com

- Username: Please request for one

- Password: Please request for one

Production credentials will be given by a member of the PremFina Integrations team after UAT is signed off or just prior to go-live

¶ 🌐 Setting Up

In this section, details about how to set up for using PremFina API is offered.

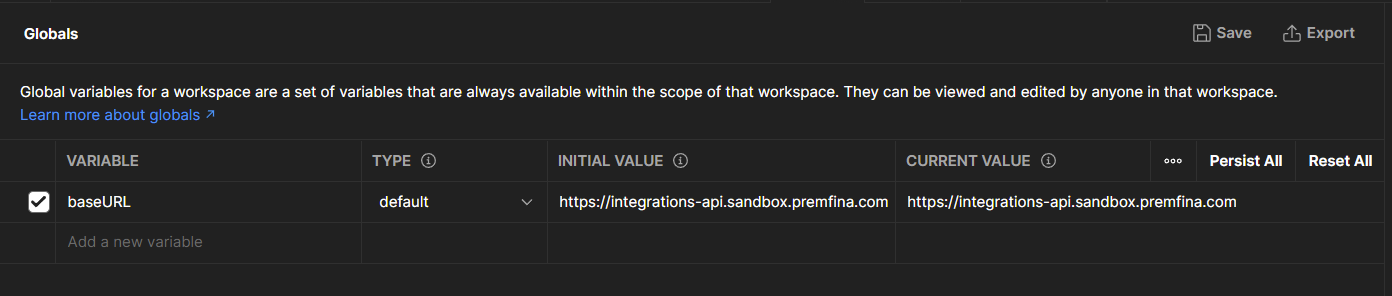

🌐 Setting Up Postman

- Firstly: Please download and install the latest copy of Postman https://www.postman.com

- Secondly: Follow the instructions offered by Postman to install the software on your system

- Thirdly: Add a new environment and set it up using these values: Variable: “baseURL”, Type: “default”, Initial Value: “https://integrations-api.sandbox.premfina.com”, Current Value: “https://integrations-api.sandbox.premfina.com” - Please note that Postman may update the product and render these instruction out of date.

- Finally: Save the environment settings. Ensure that you are are connected to PremFina via a VPN or a whitelisted Static IP. Start making calls our system as desired.

🌐 PremFina Integrations Postman Collections

Please find here a basic ‘Postman’ collection which you can import in order to check out some of the endpoints right away. This is meant to offer a basic introduction.

There may be a few variables which are blank and you will need to enter a value such as bank account details.

- We recommend the “PremFina Postman Collection” to be downloaded and imported into Postman as a JSON file.

- The environment details can be be imported into Postman as JSON files (Manage Environments).

Please download the PremFina Postman Collections from this link: PremFina Postman Collections

¶ 🖥️ Integrations API Workflows

The PremFina API consist of numerous workflows. For the sake of simplicity, the most common workflows are exemplified in this section.

¶ API Workflows

A New Business workflow is below, is typically based on a regular quote and buy journey typically seen when purchasing insurance.

Depending on how you are set up, there are three pathways of a New Business workflow. The various pathways of a New Business workflow can be found in this document: API pathways. However, we strongly recommend the one exemplified in this section.

🔒 Step 1 - Login

(Retrieve Auth Token needed for later calls)

Call the Login endpoint, sending your username and password, to return an authentication token, used for subsequent calls.

See the FAQ for more info on Tokens.

/login

Log in to obtain token Click to expand

Sample Payload:

{

"user": "API_USER_CRA",

"password": "PWLAP1$U$3R781"

}

Response from log in - token obtained Click to expand

Sample Response:

pO8udqWwsbLMzcZRTYVs6RpqI4WGEiuPX1SuY5SLfoxHjjgA20

👀 Step 2 (Optional) - Get Quote without any broker or facility fee

This step is an optional step. It can be skipped. A New Business workflow may include getting a basic quote that does not involve CRA checks. This will return a basic quote based on the scheme code, deposit, premium and agreement start date. Executing this step is mostly useful for user journeys that involves showing the client a quote before they decide on a pay month or pay yearly option.

/v2/get/quote/{token}

Get Quote Click to expand

Sample Payload:

{

"schemeCode" : "APIC01",

"deposit" : "20",

"premium" : "200",

"startDate" : "2021-02-10"

}

Response from Get Quote Click to expand

Sample Response:

{

"getQuote": {

"schemeCode": "APIC01",

"deposit": 20,

"premium": 200,

"flatRate": null,

"startDate": "2021-02-10"

},

"sharedXref": null,

"existingAgreementNumber": null,

"agreementNumber": "000083156",

"createdOn": "2020-10-19",

"daysValid": null,

"daysRemaining": null,

"activated": null,

"activatedOn": null,

"scheme": {

"branchId": "5476010",

"classificationId": "100000",

"brandId": "107638",

"brandName": "Premium Finance Start Brand",

"hostCompany": {

"name": "PremFina Ltd"

},

"broker": {

"brokerOwnReference": null,

"source": "API CRA Broker"

},

"introducer": {

"name": "API CRA Broker",

"code": "APIC",

"id": "307011"

},

"newBusinessNumberOfInstalments": 12,

"renewalNumberOfInstalments": 11,

"newBusinessFlatRate": "10",

"newBusinessMinFlatRate": "5",

"newBusinessMaxFlatRate": "15",

"renewalFlatRate": "10",

"renewalMinFlatRate": "5",

"renewalMaxFlatRate": "15",

"code": "APIC01",

"providerName": "API Insurer",

"providerId": "307012",

"cancellationType": "Pro Rata - Cancellable",

"recourseLevel": "Recourse",

"type": "Personal",

"minLoanAmount": "100",

"maxLoanAmount": "10000",

"active": true,

"minimumCreditChargeActive": false,

"minimumCreditCharge": null,

"newBusinessMinimumDepositPercentage": "0",

"newBusinessMaximumDepositPercentage": "20",

"newBusinessMinimumDepositAmount": null,

"newBusinessMaximumDepositAmount": null,

"newBusinessDepositPercentageOfPremium": null,

"renewalMinimumDepositPercentage": "5",

"renewalMaximumDepositPercentage": "20",

"renewalMinimumDepositAmount": null,

"renewalMaximumDepositAmount": null,

"renewalDepositPercentageOfPremium": "15",

"product": {

"name": "Premium Finance Start Product",

"id": "107637"

}

},

"loanAdvance": 180.00,

"loanInterest": "18.00",

"deposit": 20.00,

"noInstallments": 12,

"flatRate": "10.0",

"firstInstalmentAmount": 16.5,

"regularInstalmentAmount": 16.5,

"apr": "21.41",

"customerId": null,

"feeCharges": [],

"softwareHouse": null,

"loanFees": 0,

"totalPayable": 198.00,

"minimumCreditChargeMet": true,

"preCheckResponse": null,

"preCheckResponseBreakdown": null,

"schedule": null,

"clientRef": null

}

👀 Step 2 (Optional) - Get Quote with facility fee (Without Broker Fee)

This step is an optional step. It can be skipped. A New Business workflow may include getting a basic quote that does not involve CRA checks. This will return a basic quote based on the scheme code, deposit, premium and agreement start date. Executing this step is mostly useful for user journeys that involves showing the client a quote before they decide on a pay month or pay yearly option.

/v2/get/quote/{token}

Get Quote Click to expand

Sample Payload:

{

"schemeCode" : "APIC01",

"deposit" : "20",

"premium" : "200",

"startDate" : "2021-02-10"

}

Response from Get Quote Click to expand

Sample Response:

{

"getQuote": {

"schemeCode": "APIC01",

"deposit": 20,

"premium": 200,

"flatRate": null,

"startDate": "2021-02-10"

},

"sharedXref": null,

"existingAgreementNumber": null,

"agreementNumber": "000232570",

"createdOn": "2023-10-11",

"daysValid": null,

"daysRemaining": null,

"activated": null,

"activatedOn": null,

"scheme": {

"branchId": "5476010",

"classificationId": "100000",

"brandId": "117635",

"brandName": "PF NBC 30D RNWLC 5WD BRAND",

"hostCompany": {

"name": "PremFina Ltd"

},

"broker": {

"brokerOwnReference": null,

"source": "API CRA Broker"

},

"introducer": {

"name": "API CRA Broker",

"code": "APIC01",

"id": "349011"

},

"newBusinessNumberOfInstalments": 9,

"renewalNumberOfInstalments": 10,

"newBusinessFlatRate": "11.58",

"newBusinessMinFlatRate": "5.78",

"newBusinessMaxFlatRate": "11.58",

"renewalFlatRate": "11.58",

"renewalMinFlatRate": "5.78",

"renewalMaxFlatRate": "11.58",

"code": "PAC001",

"providerName": "Allianz Insurance PLC",

"providerId": "105548",

"cancellationType": "Pro Rata - Cancellable",

"recourseLevel": "Non-Recourse",

"type": "Personal",

"minLoanAmount": "100",

"maxLoanAmount": "100000",

"active": true,

"minimumCreditChargeActive": false,

"minimumCreditCharge": null,

"newBusinessMinimumDepositPercentage": "5",

"newBusinessMaximumDepositPercentage": "30",

"newBusinessMinimumDepositAmount": null,

"newBusinessMaximumDepositAmount": null,

"newBusinessDepositPercentageOfPremium": null,

"renewalMinimumDepositPercentage": "0",

"renewalMaximumDepositPercentage": null,

"renewalMinimumDepositAmount": null,

"renewalMaximumDepositAmount": null,

"renewalDepositPercentageOfPremium": "0",

"product": {

"name": "PF NBC 30D RNWLC 5WD PRODUCT",

"id": "117639"

}

},

"loanAdvance": 180.00,

"loanInterest": "20.84",

"deposit": 20.00,

"noInstallments": 9,

"flatRate": "15.4370370",

"firstInstalmentAmount": 16.5,

"regularInstalmentAmount": 16.5,

"apr": "30.5964160",

"customerId": null,

"feeCharges": [

{

"type": "Facility Fee",

"amount": 20.00,

"addToTotalRepayable": true,

"reference": null

}

],

"softwareHouse": null,

"loanFees": 70.00,

"totalPayable": 200.84,

"minimumCreditChargeMet": true,

"preCheckResponse": null,

"preCheckResponseBreakdown": null,

"schedule": null,

"clientRef": null

}

👀 Step 2 (Optional) - Get Quote with broker and facility fee

This step is an optional step. It can be skipped. A New Business workflow may include getting a basic quote that does not involve CRA checks. This will return a basic quote based on the scheme code, deposit, premium and agreement start date. Executing this step is mostly useful for user journeys that involves showing the client a quote before they decide on a pay month or pay yearly option.

Also, the broker fee is optional. Please use the other variation if broker fee is not applicable in your scenario.

/v2/get/quote/{token}

Get Quote Click to expand

Sample Payload:

{

"feeCharges": [

{

"addToTotalRepayable": true,

"amount": 50,

"reference": "Sample Ref",

"type": "Broker Fee"

}

],

"schemeCode" : "APIC01",

"deposit" : "20",

"premium" : "200",

"startDate" : "2021-02-10"

}

Response from Get Quote Click to expand

Sample Response:

{

"getQuote": {

"schemeCode": "APIC01",

"deposit": 20,

"premium": 200,

"flatRate": null,

"startDate": "2021-02-10"

},

"sharedXref": null,

"existingAgreementNumber": null,

"agreementNumber": "000232570",

"createdOn": "2023-10-11",

"daysValid": null,

"daysRemaining": null,

"activated": null,

"activatedOn": null,

"scheme": {

"branchId": "5476010",

"classificationId": "100000",

"brandId": "117635",

"brandName": "PF NBC 30D RNWLC 5WD BRAND",

"hostCompany": {

"name": "PremFina Ltd"

},

"broker": {

"brokerOwnReference": null,

"source": "API CRA Broker"

},

"introducer": {

"name": "API CRA Broker",

"code": "APIC01",

"id": "349011"

},

"newBusinessNumberOfInstalments": 9,

"renewalNumberOfInstalments": 10,

"newBusinessFlatRate": "11.58",

"newBusinessMinFlatRate": "5.78",

"newBusinessMaxFlatRate": "11.58",

"renewalFlatRate": "11.58",

"renewalMinFlatRate": "5.78",

"renewalMaxFlatRate": "11.58",

"code": "PAC001",

"providerName": "Allianz Insurance PLC",

"providerId": "105548",

"cancellationType": "Pro Rata - Cancellable",

"recourseLevel": "Non-Recourse",

"type": "Personal",

"minLoanAmount": "100",

"maxLoanAmount": "100000",

"active": true,

"minimumCreditChargeActive": false,

"minimumCreditCharge": null,

"newBusinessMinimumDepositPercentage": "5",

"newBusinessMaximumDepositPercentage": "30",

"newBusinessMinimumDepositAmount": null,

"newBusinessMaximumDepositAmount": null,

"newBusinessDepositPercentageOfPremium": null,

"renewalMinimumDepositPercentage": "0",

"renewalMaximumDepositPercentage": null,

"renewalMinimumDepositAmount": null,

"renewalMaximumDepositAmount": null,

"renewalDepositPercentageOfPremium": "0",

"product": {

"name": "PF NBC 30D RNWLC 5WD PRODUCT",

"id": "117639"

}

},

"loanAdvance": 180.00,

"loanInterest": "20.84",

"deposit": 20.00,

"noInstallments": 9,

"flatRate": "15.4370370",

"firstInstalmentAmount": 16.5,

"regularInstalmentAmount": 16.5,

"apr": "30.5964160",

"customerId": null,

"feeCharges": [

{

"type": "Facility Fee",

"amount": 20.00,

"addToTotalRepayable": true,

"reference": null

},

{

"type": "Broker Fee",

"amount": 50,

"addToTotalRepayable": true,

"reference": "Sample Ref"

}

],

"softwareHouse": null,

"loanFees": 70.00,

"totalPayable": 200.84,

"minimumCreditChargeMet": true,

"preCheckResponse": null,

"preCheckResponseBreakdown": null,

"schedule": null,

"clientRef": null

}

💵 Step 3 - Create a Persist Quote

Firstly, depending on if it is personal or commercial agreement, the payloads are slightly unique.

Also, because there are Credit Risk and Affordability (CRA) checks when applying for a loan, a question which is frequently asked is “Will the customer have a hard inquiry on their credit report?”

This step (Step 3) does the following: (1) Create a quote. (2) Does a Soft inquiry, and returns the result of of the quote including the CRA. For more information on CRA, please see the FAQ section on this page.

The results of the persist quote (including the CRA) allows you to decide whether to offer PremFina as a finance option. If the result of the soft inquiry indicates we may refer the loan, you may choose to not offer this option to the customer.

Another question that is frequently asked during a persist quote is “What is the data format, length and mandatory fields?” a

Click here to download a file that contains the list of mandatory fields, accepted values and data format: premfina_mandatory_fields_api.xlsx

Use this endpoint below to create a New Business persist quote for personal lines.

/v2/persist/quote/{token}

Persist Quote Payload (New Business - Personal Lines) Click to expand

{

"daysValid": "30",

"preCheck": true,

"getQuote": {

"schemeCode": "APIC001",

"deposit" : "30",

"premium" : "500",

"startDate" : "2024-07-25"

},

"config": {

"preferredPaymentDay": 28

},

"agreement": {

"customer": {

"addresses": [{

"addressLine1": "22",

"addressLine2": " PATTERDALE DRIVE",

"postalTown": "YORK",

"country": "United Kingdom",

"postCode": "YO305TW"

}],

"contacts": [{

"email": "testing@premfina.com",

"mobile": "07443577777"

}],

"title": "MR",

"surname": "DAVID TRUEMAN",

"firstName": "GRAHAM",

"dateOfBirth": "31-12-1960"

},

"policies": [{

"startDate": "25-07-2024",

"cancellationType": "Pro Rata - Cancellable",

"reference": "PFTEST1",

"insurer": "Aviva Plc",

"coverType": "Car",

"premium": "500"

}]

}

}

Persist Quote Payload (New Business - Commercial Lines [Limited Company]) Click to expand

{

"agreement": {

"clientRef": "20121376",

"softwareHouse": null,

"config": {

"preferredPaymentDay": 14

},

"policies":[

{

"startDate":"02-10-2020",

"cancellationType":"Pro Rata - Cancellable",

"reference":"PFTEST1",

"insurer":"Aviva Plc",

"coverType":"Car",

"premium":"542"

}

],

"feeCharges": [

{

"type": "Broker Fee",

"amount": 50.0,

"addToTotalRepayable": true,

"reference": "PL-SD-01_009"

}

],

"directDebitsAreSuppressed": true,

"preCheck": true,

"broker": {

"brokerOwnReference": "525200263"

},

"companyCustomer": {

"companyName": "dltest",

"companyNumber": "3998084",

"customerType": "Company",

"identityType": "MainCustomer",

"numberOfPartners": 2,

"companyType": {

"description": "Limited Company"

},

"addresses": [

{

"addressLine1": "100 Hatton Garden",

"addressLine2": "",

"postalTown": "London",

"country": "United Kingdom",

"postCode": "EC1N 8NX"

}

],

"bankAccounts": [

{

"accountName": "PremFina",

"accountNumber": "00000001",

"sortCode": "000001"

}

],

"contacts": [

{

"email": "test@test.com",

"landline": "1234567890",

"mobile": "1234567890"

}

],

"relations": []

}

},

"daysValid": 30,

"getQuote": {

"deposit": 0.0,

"flatRate": 10.0,

"premium": 592.0,

"schemeCode": "APIC04",

"startDate": "2023-07-14"

},

"relations": [

{

"person": {

"dateOfBirth": "01-01-1980",

"firstName": "partner",

"surname": "one",

"title": "Ms"

}

},

{

"person": {

"dateOfBirth": "01-01-1990",

"firstName": "partner",

"surname": "two",

"title": "Dr"

}

}

]

}

Persist Quote Payload (New Business - Commercial Lines [Sole Trader]) Click to expand

{

"agreement": {

"clientRef": "20121376",

"softwareHouse": null,

"config": {

"preferredPaymentDay": 28

},

"policies":[

{

"startDate":"02-10-2020",

"cancellationType":"Pro Rata - Cancellable",

"reference":"PFTEST1",

"insurer":"Aviva Plc",

"coverType":"Car",

"premium":"542"

}

],

"feeCharges": [

{

"type": "Broker Fee",

"amount": 50.0,

"addToTotalRepayable": true,

"reference": "PL-SD-01_009"

}

],

"directDebitsAreSuppressed": true,

"preCheck": true,

"broker": {

"brokerOwnReference": "527006736"

},

"companyCustomer": {

"companyName": "dltest",

"customerType": "Company",

"identityType": "MainCustomer",

"companyType": {

"description": "Sole Trader"

},

"addresses": [

{

"addressLine1": "100 Hatton Garden",

"addressLine2": "",

"postalTown": "London",

"country": "United Kingdom",

"postCode": "EC1N 8NX"

}

],

"bankAccounts": [

{

"accountName": "premfina",

"accountNumber": "00000001",

"sortCode": "000001"

}

],

"contacts": [

{

"email": "test@test.com",

"mobile": "123456789"

}

],

"relations": []

}

},

"daysValid": 30,

"getQuote": {

"deposit": 0,

"flatRate": 10,

"premium": 592,

"schemeCode": "APIC02",

"startDate": "2023-09-28"

},

"relations": [

{

"person": {

"dateOfBirth": "19-06-1990",

"firstName": "sole",

"surname": "trader",

"title": "Mr",

"addresses": [

{

"addressLine1": "TEST",

"addressLine2": "TEST",

"postalTown": "TEST",

"county": "TEST",

"country": "UK",

"postcode": "TEST",

"currentlyResident": true,

"movingInDate": "11-04-2015",

"movingOutDate": null

}

]

}

}

]

}

Persist Quote Reponse (New Business - Personal Lines) Click to expand

{

"getQuote": {

"schemeCode": "APIC01",

"deposit": 100,

"premium": 542,

"flatRate": 10,

"startDate": "2020-10-02"

},

"sharedXref": "API CRA Broker-8779329637268283",

"existingAgreementNumber": null,

"agreementNumber": "000097513",

"createdOn": "2020-10-19",

"daysValid": 30,

"daysRemaining": 30,

"activated": null,

"activatedOn": null,

"scheme": {

"branchId": "5476010",

"classificationId": "100000",

"brandId": "107638",

"brandName": "Premium Finance Start Brand",

"hostCompany": {

"name": "PremFina Ltd"

},

"broker": {

"brokerOwnReference": null,

"source": "API CRA Broker"

},

"introducer": {

"name": "API CRA Broker",

"code": "APIC",

"id": "307011"

},

"newBusinessNumberOfInstalments": 12,

"renewalNumberOfInstalments": 11,

"newBusinessFlatRate": "10",

"newBusinessMinFlatRate": "5",

"newBusinessMaxFlatRate": "15",

"renewalFlatRate": "10",

"renewalMinFlatRate": "5",

"renewalMaxFlatRate": "15",

"code": "APIC01",

"providerName": "Aviva Plc",

"providerId": "105556",

"cancellationType": "Pro Rata - Cancellable",

"recourseLevel": "Recourse",

"type": "Personal",

"minLoanAmount": "100",

"maxLoanAmount": "10000",

"active": true,

"minimumCreditChargeActive": false,

"minimumCreditCharge": null,

"newBusinessMinimumDepositPercentage": "0",

"newBusinessMaximumDepositPercentage": "20",

"newBusinessMinimumDepositAmount": null,

"newBusinessMaximumDepositAmount": null,

"newBusinessDepositPercentageOfPremium": null,

"renewalMinimumDepositPercentage": "5",

"renewalMaximumDepositPercentage": "20",

"renewalMinimumDepositAmount": null,

"renewalMaximumDepositAmount": null,

"renewalDepositPercentageOfPremium": "15",

"product": {

"name": "Premium Finance Start Product",

"id": "107637"

}

},

"loanAdvance": 442.00,

"loanInterest": "44.20",

"deposit": 100.00,

"noInstallments": 12,

"flatRate": "10.0",

"firstInstalmentAmount": 40.59,

"regularInstalmentAmount": 40.51,

"apr": "21.41",

"customerId": 37598350,

"feeCharges": [],

"softwareHouse": null,

"loanFees": 0,

"totalPayable": 486.20,

"minimumCreditChargeMet": true,

"preCheckResponse": "Passed",

"preCheckResponseBreakdown": {

"defaultsResult": "approved",

"idResult": "passed",

"amlResult": "approved",

"creditResult": "approved"

},

"schedule": null,

"clientRef": null

}

Persist Quote Reponse (New Business - Commercial Lines) Click to expand

{

"getQuote": {

"schemeCode": "APIC04",

"deposit": 0.0,

"premium": 592.0,

"flatRate": 10.0,

"startDate": "2023-07-14"

},

"sharedXref": "API CRA Broker-8779471600990464",

"existingAgreementNumber": null,

"agreementNumber": "000097514",

"createdOn": "2020-10-19",

"daysValid": 30,

"daysRemaining": 30,

"activated": null,

"activatedOn": null,

"scheme": {

"branchId": "5476010",

"classificationId": "100000",

"brandId": "107638",

"brandName": "Premium Finance Start Brand",

"hostCompany": {

"name": "PremFina Ltd"

},

"broker": {

"brokerOwnReference": null,

"source": "API CRA Broker"

},

"introducer": {

"name": "API CRA Broker",

"code": "APIC",

"id": "307011"

},

"newBusinessNumberOfInstalments": 12,

"renewalNumberOfInstalments": 12,

"newBusinessFlatRate": "10",

"newBusinessMinFlatRate": "0",

"newBusinessMaxFlatRate": "15",

"renewalFlatRate": "10",

"renewalMinFlatRate": "0",

"renewalMaxFlatRate": "15",

"code": "APIC04",

"providerName": "Aviva Plc",

"providerId": "105556",

"cancellationType": "Pro Rata - Cancellable",

"recourseLevel": "Recourse",

"type": "Commercial",

"minLoanAmount": "100",

"maxLoanAmount": "10000",

"active": true,

"minimumCreditChargeActive": false,

"minimumCreditCharge": null,

"newBusinessMinimumDepositPercentage": "0",

"newBusinessMaximumDepositPercentage": "0",

"newBusinessMinimumDepositAmount": null,

"newBusinessMaximumDepositAmount": null,

"newBusinessDepositPercentageOfPremium": "0",

"renewalMinimumDepositPercentage": "0",

"renewalMaximumDepositPercentage": "0",

"renewalMinimumDepositAmount": null,

"renewalMaximumDepositAmount": null,

"renewalDepositPercentageOfPremium": "0",

"product": {

"name": "Premium Finance Start Product",

"id": "107637"

}

},

"loanAdvance": 592.00,

"loanInterest": "59.20",

"deposit": 0.00,

"noInstallments": 12,

"flatRate": "10.0",

"firstInstalmentAmount": 54.34,

"regularInstalmentAmount": 54.26,

"apr": "21.41",

"customerId": 37598360,

"feeCharges": [

{

"type": "Broker Fee",

"amount": 50.0,

"addToTotalRepayable": true,

"reference": "PL-SD-01_009"

}

],

"relationError": "Index 0 out of bounds for length 0",

"softwareHouse": null,

"loanFees": 50.0,

"totalPayable": 651.20,

"minimumCreditChargeMet": true,

"preCheckResponse": null,

"preCheckResponseBreakdown": null,

"schedule": null,

"clientRef": "20121376"

}

NOTE: Within the response of the persist quote, there is a value for the field sharedXref. You will need this data in step 4 and step 5.

NOTE: The persist quote payload and response exemplified in this section is for New Business personal lines. For commercial lines and other examples, please download the PremFina Postman Collections from this link: PremFina Postman Collections

Upon creating a persist quote, you may choose to proceed towards activating the quote or decline the quote. We often recommend to decline any quote which you do not intend to activate.

If you do not want to proceed to activate the quote that you created in this step, then you must decline the quote (removing it from the list of active quotes). To do this use, please use the endpoint below:

/agreement/{agreementNumber}/decline/{token}

If you do want to proceed with the persited quote that you created in this step, then you can display the information to the customer.

👨🏫 Step 3 (Continued) - Display the information to customer

NOTE: If you are displaying the PremFina option to customers then there are some details you must show to the customer before they accept the quote.

You will have all this information (bar the link) in the response from the previosly called /persist/quote/{token}.

- This link, to our Premium Finance Information: https://premfina.com/premium-finance-information/

- Total Amount Payable, Number of Instalments, Instalment Amount, Interest Rate, First Instalment Due Date.

🏦 Step 4 - Add Bank Details to Quote. This step is optional and only required if the quote was created without bank details

When creating a persistant quote in step 3, you have the option of adding the bank details within the perist/quote payload (see the Postman collections for sample payload). However, this exemplification breaks down the user journey experienced in a typical quote to buy where a quote is generated and if the client chooses to proceed with the monthly option, bank details are requested.

If you did not create the quote with bank details, you will need to add the bank details after collecting from the customer.

NOTE: You will need the sharedXref which was returned as part of the response for step 3 (/persist/quote/)

In order to update the quote with the bank details, use the endpoint below:

/update/pquote/{sharedXref}/{token}

Use the payload below in the body of your request with the test bank account details within it.

{

"sortCode": "000001",

"accountNumber": "00000001",

"accountName": "Test Account"

}

On production environment, PremFina uses an external bank checker service to validate the bank account details on various aspect.

Also, please note that PremFina does not require you to store the bank details of customers. This step (Step 4) is about you capturing the bank details and passing it to PremFina via the API. PremFina will use the bank details to set up a direct debit mandate which would be used to facilitate the monthly repayment of the loan.

The response for adding a bank details to a quote is similar to a persist quote. See example below.

Add Bank Details to Quote Reponse Click to expand

{

"agreementId": null,

"agreementNumber": "000090308",

"broker": {

"brokerOwnReference": "API CRA Broker",

"source": "API CRA Broker"

},

"hostCompany": {

"name": "PremFina Ltd"

},

"clientRef": null,

"customer": {

"id": null,

"addresses": [

{

"id": null,

"addressLine1": "22",

"addressLine2": " PATTERDALE DRIVE",

"district": null,

"postalTown": "YORK",

"county": null,

"country": "United Kingdom",

"postCode": "YO305TW",

"currentlyResident": null,

"movingInDate": null,

"movingOutDate": null

}

],

"contacts": [

{

"email": "testing@premfina.com",

"landline": null,

"mobile": "07443577777",

"fax": null

}

],

"bankAccounts": [

{

"sortCode": "000001",

"accountNumber": "00000001",

"accountName": "Returns Account",

"mandateConsent": null

}

],

"customerType": "Person",

"identityType": "MainCustomer",

"emailAddress": null,

"title": "MR",

"surname": "DAVID TRUEMAN",

"firstName": "GRAHAM",

"middleNames": null,

"dateOfBirth": "31-12-1960",

"occupation": null,

"employmentStatus": null

},

"companyCustomer": null,

"quote": {

"getQuote": {

"schemeCode": "APIC01",

"deposit": 100,

"premium": 542,

"flatRate": 10,

"startDate": "2020-10-02"

},

"sharedXref": "API CRA Broker-7553865294947815",

"existingAgreementNumber": null,

"agreementNumber": "000090308",

"createdOn": "2023-01-11",

"daysValid": null,

"daysRemaining": null,

"activated": null,

"activatedOn": null,

"scheme": {

"branchId": "5476010",

"classificationId": "100000",

"brandId": "107638",

"brandName": "Premium Finance Start Brand",

"hostCompany": {

"name": "PremFina Ltd"

},

"broker": {

"brokerOwnReference": null,

"source": "API CRA Broker"

},

"introducer": {

"name": "API CRA Broker",

"code": "APIC",

"id": "307011"

},

"newBusinessNumberOfInstalments": 12,

"renewalNumberOfInstalments": 11,

"newBusinessFlatRate": "10",

"newBusinessMinFlatRate": "5",

"newBusinessMaxFlatRate": "15",

"renewalFlatRate": "10",

"renewalMinFlatRate": "5",

"renewalMaxFlatRate": "15",

"code": "APIC01",

"providerName": "Aviva Plc",

"providerId": "105556",

"cancellationType": "Pro Rata - Cancellable",

"recourseLevel": "Recourse",

"type": "Personal",

"minLoanAmount": "100",

"maxLoanAmount": "10000",

"active": true,

"minimumCreditChargeActive": false,

"minimumCreditCharge": null,

"newBusinessMinimumDepositPercentage": "0",

"newBusinessMaximumDepositPercentage": "20",

"newBusinessMinimumDepositAmount": null,

"newBusinessMaximumDepositAmount": null,

"newBusinessDepositPercentageOfPremium": null,

"renewalMinimumDepositPercentage": "5",

"renewalMaximumDepositPercentage": "20",

"renewalMinimumDepositAmount": null,

"renewalMaximumDepositAmount": null,

"renewalDepositPercentageOfPremium": "15",

"product": {

"name": "Premium Finance Start Product",

"id": "107637"

}

},

"loanAdvance": 442.00,

"loanInterest": "44.20",

"deposit": 100.00,

"noInstallments": 12,

"flatRate": "10.0000000",

"installmentAmount": 40.51,

"apr": "19.5319950",

"customerId": 35728170,

"feeCharges": [],

"softwareHouse": null,

"loanFees": 0,

"totalPayable": 486.20,

"minimumCreditChargeMet": true,

"preCheckResponse": "Passed",

"preCheckResponseBreakdown": {

"defaultsResult": "approved",

"idResult": "passed",

"amlResult": "approved",

"creditResult": "approved"

},

"schedule": null,

"clientRef": null

},

"params": [],

"policies": [

{

"startDate": "02-10-2020",

"cancellationType": "Pro Rata - Cancellable",

"reference": "PFTEST1",

"insurer": "Aviva Plc",

"providerId": 105556,

"premium": 542,

"coverType": "Car"

}

],

"introducerId": null,

"introducerName": "API CRA Broker",

"config": null,

"loanAdvance": null,

"installment": null,

"liveDate": null,

"maturityDate": null,

"numberOfPayments": null,

"nextDueDate": null,

"loanInterest": null,

"status": null,

"flatRate": null,

"apr": null,

"deposit": 100,

"arrears": null,

"outstandingBalance": null,

"feeBalance": null,

"mandateStatusId": null,

"mandateStatusDescription": null,

"directDebitsAreSuppressed": null,

"softwareHouse": null,

"currencyCode": null,

"pendingCancellation": false,

"pendingCancellationDateTime": null

}

💰 Step 5 - Activate Persist Quote

(Also known as taking up the proposal)

This is the step where you can activate the quote using the endpoint below. The sharedXref derived from step 3 is required for activating the loan.

/activate/quote/{sharedXref}/{token}

Upon trying to activate the loan, there are three possible outcomes.

- Outcome 1: “200 OK” - This is when the activation is successful. Which means that the CRA check passed and the proposal is now active.

- Outcome 2: “201 OK - Proposal xxxxxxxx Referred” - This is when the activation is unsuccessful. Which means that the CRA check failed and the proposal is not active. The Credit team will follow up with a manual review to make a decision. The client and broker will be involved/informed as necessary. When a proposal is referred, you may want to include in your user journey to display holding message to the client that tells them that you will get back to them.

- Outcome 3: “400 Bad request” - This is an unsuccessful activation due to duplicate quote already existing or problem with the payload sent, missing bank details and more. If you get this code, please investigate before reaching out to us.

The example below is for outcome 1 where the proposal is successfully activated. Other examples exist in the Postman collections.

NOTE: You will need the sharedXref which was returned as part of the response for step 3 (/persist/quote/)

The response for adding a bank details to a quote is similar to a persist quote. See example below.

Activate Persist Quote Reponse Click to expand

{

"agreementNumber": "000090310",

"schedule": [

{

"date": "2020-10-26",

"amount": 40.59,

"number": 1,

"status": "Due"

},

{

"date": "2020-11-02",

"amount": 40.51,

"number": 2,

"status": "Due"

},

{

"date": "2020-12-02",

"amount": 40.51,

"number": 3,

"status": "Due"

},

{

"date": "2021-01-02",

"amount": 40.51,

"number": 4,

"status": "Due"

},

{

"date": "2021-02-02",

"amount": 40.51,

"number": 5,

"status": "Due"

},

{

"date": "2021-03-02",

"amount": 40.51,

"number": 6,

"status": "Due"

},

{

"date": "2021-04-02",

"amount": 40.51,

"number": 7,

"status": "Due"

},

{

"date": "2021-05-02",

"amount": 40.51,

"number": 8,

"status": "Due"

},

{

"date": "2021-06-02",

"amount": 40.51,

"number": 9,

"status": "Due"

},

{

"date": "2021-07-02",

"amount": 40.51,

"number": 10,

"status": "Due"

},

{

"date": "2021-08-02",

"amount": 40.51,

"number": 11,

"status": "Due"

},

{

"date": "2021-09-02",

"amount": 40.51,

"number": 12,

"status": "Due"

}

]

}

Once the quote has been activated, the agreement is live and active.

The PremFina system will automatically generate and send out an email with a welcome letter, SECCI and payment schedule documents attached to the email will be generated and emailed to the customer.

Additionally, the PremFina system will automatically generate and send out an email with a link that the customers can use to provide an e-signature for the SECCI credit agreement.

Therefore, you do not need to implement stpe 6.

✨ Step 6 - (Optional) Get Agreement Details or Status

This step is optional. It can be used as part of a user journey or back office operations. It can be used to get details related to the agreement such as: the status of an agreement (in the case of a referred proposal), monthly schedule, CRA check results, direct debit mandate status and many more.

You can use the endpoint below to get the status of an agreement.

{{baseURL}}/v2/agreement/{{agreementNumber}}/{{token}}

An example response for get agreement looks like the below:

The Reponse For Get Agreement Details Click to expand

{

"agreementId": "927486",

"agreementNumber": "000097515",

"broker": {

"brokerOwnReference": "API CRA Broker",

"source": "API CRA Broker"

},

"hostCompany": {

"name": "PremFina Ltd"

},

"clientRef": null,

"customer": null,

"companyCustomer": {

"id": "37598380",

"addresses": [

{

"id": "4321934",

"addressLine1": "100",

"addressLine2": "Hatton Garden",

"district": "",

"postalTown": "London",

"county": "",

"country": "United Kingdom",

"postCode": "EC1N8NX",

"currentlyResident": true,

"movingInDate": "2020-10-19",

"movingOutDate": null

}

],

"contacts": [

{

"email": "test@test.com",

"landline": "",

"mobile": null,

"fax": ""

}

],

"bankAccounts": [

null

],

"customerType": "Company",

"identityType": "MainCustomer",

"emailAddress": "test@test.com",

"companyName": "dltest",

"companyNumber": "",

"companyType": {

"id": 395,

"description": "Sole Trader"

},

"numberOfPartners": null,

"businessType": null

},

"quote": {

"getQuote": {

"schemeCode": "APIC02",

"deposit": 0,

"premium": 592,

"flatRate": 10,

"startDate": "2023-09-28"

},

"sharedXref": "API CRA Broker-8779712387059832",

"existingAgreementNumber": "000097515",

"agreementNumber": "000097515",

"createdOn": "2020-10-19",

"daysValid": 30,

"daysRemaining": 30,

"activated": null,

"activatedOn": null,

"scheme": {

"branchId": "5476010",

"classificationId": "100000",

"brandId": "119637",

"brandName": "PF NBS 5WD RNWLS 5WD BRAND",

"hostCompany": {

"name": "PremFina Ltd"

},

"broker": {

"brokerOwnReference": null,

"source": "API CRA Broker"

},

"introducer": {

"name": "API CRA Broker",

"code": "APIC",

"id": "307011"

},

"newBusinessNumberOfInstalments": 12,

"renewalNumberOfInstalments": 12,

"newBusinessFlatRate": "12",

"newBusinessMinFlatRate": "10",

"newBusinessMaxFlatRate": "15",

"renewalFlatRate": "12",

"renewalMinFlatRate": "10",

"renewalMaxFlatRate": "15",

"code": "APIC02",

"providerName": "Aviva Plc",

"providerId": "105556",

"cancellationType": "Pro Rata - Cancellable",

"recourseLevel": "Recourse",

"type": "Personal",

"minLoanAmount": "100",

"maxLoanAmount": "10000",

"active": true,

"minimumCreditChargeActive": true,

"minimumCreditCharge": "0",

"newBusinessMinimumDepositPercentage": "0",

"newBusinessMaximumDepositPercentage": "20",

"newBusinessMinimumDepositAmount": null,

"newBusinessMaximumDepositAmount": null,

"newBusinessDepositPercentageOfPremium": null,

"renewalMinimumDepositPercentage": "0",

"renewalMaximumDepositPercentage": "20",

"renewalMinimumDepositAmount": null,

"renewalMaximumDepositAmount": null,

"renewalDepositPercentageOfPremium": null,

"product": {

"name": "PF NBS 5WD RNWLS 5WD PRODUCT",

"id": "118632"

}

},

"loanAdvance": 592.00,

"loanInterest": "59.20",

"deposit": 0.00,

"noInstallments": 12,

"flatRate": "10.0",

"firstInstalmentAmount": 54.34,

"regularInstalmentAmount": 54.26,

"apr": "21.41",

"customerId": 37598380,

"feeCharges": [

{

"type": "Broker Fee",

"amount": 50.0,

"addToTotalRepayable": true,

"reference": "PL-SD-01_009"

}

],

"softwareHouse": null,

"loanFees": 50.0,

"totalPayable": 651.20,

"minimumCreditChargeMet": true,

"preCheckResponse": null,

"preCheckResponseBreakdown": null,

"schedule": [

{

"date": "2023-10-28",

"amount": 54.34,

"number": 1,

"status": "Due"

},

{

"date": "2023-11-28",

"amount": 54.26,

"number": 2,

"status": "Due"

},

{

"date": "2023-12-28",

"amount": 54.26,

"number": 3,

"status": "Due"

},

{

"date": "2024-01-28",

"amount": 54.26,

"number": 4,

"status": "Due"

},

{

"date": "2024-02-28",

"amount": 54.26,

"number": 5,

"status": "Due"

},

{

"date": "2024-03-28",

"amount": 54.26,

"number": 6,

"status": "Due"

},

{

"date": "2024-04-28",

"amount": 54.26,

"number": 7,

"status": "Due"

},

{

"date": "2024-05-28",

"amount": 54.26,

"number": 8,

"status": "Due"

},

{

"date": "2024-06-28",

"amount": 54.26,

"number": 9,

"status": "Due"

},

{

"date": "2024-07-28",

"amount": 54.26,

"number": 10,

"status": "Due"

},

{

"date": "2024-08-28",

"amount": 54.26,

"number": 11,

"status": "Due"

},

{

"date": "2024-09-28",

"amount": 54.26,

"number": 12,

"status": "Due"

}

],

"clientRef": "20121376"

},

"params": [],

"policies": [

{

"startDate": "2020-10-02",

"cancellationType": "Pro Rata - Cancellable",

"reference": "PFTEST1",

"insurer": "Aviva Plc",

"providerId": 105556,

"premium": 542.00,

"coverType": "Car"

},

{

"startDate": "2020-10-02",

"cancellationType": "Pro Rata - Cancellable",

"reference": "FEE-PL-SD-01_009",

"insurer": "Broker Fee",

"providerId": 301008,

"premium": 50.00,

"coverType": "Broker Fee"

}

],

"introducerId": "307011",

"introducerName": "API CRA Broker",

"config": {

"preferredPaymentDay": 28

},

"loanAdvance": 592.00,

"firstInstalmentAmount": 54.34,

"regularInstalmentAmount": 54.26,

"liveDate": "2023-09-28",

"maturityDate": "2024-09-28",

"numberOfPayments": 12,

"nextDueDate": null,

"loanInterest": "59.20",

"status": "Proposal",

"flatRate": 10.0,

"apr": 21.41,

"deposit": 0.00,

"arrears": 0.00,

"outstandingBalance": 0.00,

"feeBalance": 0.00,

"mandateStatusId": null,

"mandateStatusDescription": null,

"directDebitsAreSuppressed": false,

"softwareHouse": null,

"currencyCode": null,

"pendingCancellation": false,

"pendingCancellationDateTime": null

}

In the case that you want to monitor the status of a referred agreement in order to determine if it has been approved or declined upon the manual assessment by the credit team, upon calling the endpoint ({{baseURL}}/agreement/{{agreementNumber}}/{{token}}), the response can be used to get the agreement details; among other information, look out for the field name ‘active’:

- “active”: true, - Referred proposal accepted

- “active”: false, - Referred proposal declined

Renewals are done towards the end of an agreement. However, before a renewal is done, the following must be checked:

- Gather information about the renewal to be done;

- Check the status of the root agreement which the renewals would be done on;

- Check the direct debit mandate status of the root agreement;

Also, when renewing an agreement, there is an optional field called “mandateConsent” which accepts the values of “true” or “false”; this field with the corresponding values may be sent during the time of renewing an agreement. The following scenarios should occur. Typically, the renewal workflow is very similar to the new business workflow.

"mandateStatus": true

or

"mandateStatus": false

Scenario 1: If a renewal is done on an agreement that has a valid mandate status, and no bank details is sent during the renewal request, then it inherits bank details from root agreement and the renewal is created.

Scenario 2: If a renewal is done on an agreement that has a valid mandate status and a different bank details is sent during the renewal request, then the renewal is created with a new mandate for new bank details.

Scenario 3: If a renewal is done on an agreement that has a cancelled mandate status, and a different bank details is sent during the renewal request, then the renewal is created and a mandate registered for the new bank details.

Scenario 4: If a renewal is done on an agreement that has a cancelled mandate status, and the same bank details similar to the root agreement bank details is sent, the renewal is created, but, the options below should be noted:

Option A: If the “mandateConsent” field is sent as “true” then the direct debit mandate is reinstated on the renewal agreement.

Option B: If the “mandateConsent” field is sent as “false” then the direct debit mandate is not reinstated on the renewal agreement. However, the agreement is still created.

🔒 Step 1 - Login

(Retrieve Auth Token needed for later calls)

Call the Login endpoint, sending your username and password, to return an authentication token, used for subsequent calls.

See the FAQ for more info on Tokens.

/login

Log in to obtain token Click to expand

Sample Payload:

{

"user": "API_USER_CRA",

"password": "PWLAP1$U$3R781"

}

Response from log in - token obtained Click to expand

Sample Response:

pO8udqWwsbLMzcZRTYVs6RpqI4WGEiuPX1SuY5SLfoxHjjgA20

👀 Step 2 (Optional) - Get Quote Renewal without any broker or facility fee

This step is an optional step. It can be skipped. A Renewal Business workflow may include getting a basic quote that does not involve CRA checks. This will return a basic quote based on the scheme code, deposit, premium and agreement start date. Executing this step is mostly useful for user journeys that involves showing the client a quote before they decide on a pay month or pay yearly option.

/v2/get/quote/renewal/{token}

Get Quote Renwal Click to expand

Sample Payload:

{

"schemeCode" : "APIC01",

"deposit" : "20",

"premium" : "200",

"startDate" : "2021-02-10"

}

Response from Get Quote Renewal Click to expand

Sample Response:

{

"getQuote": {

"schemeCode": "APIC01",

"deposit": 20,

"premium": 200,

"flatRate": null,

"startDate": "2021-02-10"

},

"sharedXref": null,

"existingAgreementNumber": null,

"agreementNumber": "000083156",

"createdOn": "2020-10-19",

"daysValid": null,

"daysRemaining": null,

"activated": null,

"activatedOn": null,

"scheme": {

"branchId": "5476010",

"classificationId": "100000",

"brandId": "107638",

"brandName": "Premium Finance Start Brand",

"hostCompany": {

"name": "PremFina Ltd"

},

"broker": {

"brokerOwnReference": null,

"source": "API CRA Broker"

},

"introducer": {

"name": "API CRA Broker",

"code": "APIC",

"id": "307011"

},

"newBusinessNumberOfInstalments": 12,

"renewalNumberOfInstalments": 11,

"newBusinessFlatRate": "10",

"newBusinessMinFlatRate": "5",

"newBusinessMaxFlatRate": "15",

"renewalFlatRate": "10",

"renewalMinFlatRate": "5",

"renewalMaxFlatRate": "15",

"code": "APIC01",

"providerName": "API Insurer",

"providerId": "307012",

"cancellationType": "Pro Rata - Cancellable",

"recourseLevel": "Recourse",

"type": "Personal",

"minLoanAmount": "100",

"maxLoanAmount": "10000",

"active": true,

"minimumCreditChargeActive": false,

"minimumCreditCharge": null,

"newBusinessMinimumDepositPercentage": "0",

"newBusinessMaximumDepositPercentage": "20",

"newBusinessMinimumDepositAmount": null,

"newBusinessMaximumDepositAmount": null,

"newBusinessDepositPercentageOfPremium": null,

"renewalMinimumDepositPercentage": "5",

"renewalMaximumDepositPercentage": "20",

"renewalMinimumDepositAmount": null,

"renewalMaximumDepositAmount": null,

"renewalDepositPercentageOfPremium": "15",

"product": {

"name": "Premium Finance Start Product",

"id": "107637"

}

},

"loanAdvance": 180.00,

"loanInterest": "18.00",

"deposit": 20.00,

"noInstallments": 11,

"flatRate": "10.0",

"firstInstalmentAmount": 18.0,

"regularInstalmentAmount": 18.0,

"apr": "23.70",

"customerId": null,

"feeCharges": [],

"softwareHouse": null,

"loanFees": 0,

"totalPayable": 198.00,

"minimumCreditChargeMet": true,

"preCheckResponse": null,

"preCheckResponseBreakdown": null,

"schedule": null,

"clientRef": null

}

👀 Step 2 (Optional) - Get Quote Renewal with broker or facility fee

This step is an optional step. It can be skipped. A New Business workflow may include getting a basic quote that does not involve CRA checks. This will return a basic quote based on the scheme code, deposit, premium and agreement start date. Executing this step is mostly useful for user journeys that involves showing the client a quote before they decide on a pay month or pay yearly option.

/v2/get/quote/{token}

Get Quote Renewal Click to expand

Sample Payload:

{

"feeCharges": [

{

"addToTotalRepayable": true,

"amount": 50,

"reference": "Sample Ref",

"type": "Broker Fee"

}

],

"schemeCode" : "APIC01",

"deposit" : "20",

"premium" : "200",

"startDate" : "2021-02-10"

}

Response from Get Quote Renewal Click to expand

Sample Response:

{

"getQuote": {

"schemeCode": "APIC01",

"deposit": 20,

"premium": 200,

"flatRate": null,

"startDate": "2021-02-10",

"feeCharges": [

{

"type": "Broker Fee",

"amount": 50,

"addToTotalRepayable": true,

"reference": "Sample Ref"

}

]

},

"sharedXref": null,

"existingAgreementNumber": null,

"agreementNumber": "000083156",

"createdOn": "2020-10-19",

"daysValid": null,

"daysRemaining": null,

"activated": null,

"activatedOn": null,

"scheme": {

"branchId": "5476010",

"classificationId": "100000",

"brandId": "107638",

"brandName": "Premium Finance Start Brand",

"hostCompany": {

"name": "PremFina Ltd"

},

"broker": {

"brokerOwnReference": null,

"source": "API CRA Broker"

},

"introducer": {

"name": "API CRA Broker",

"code": "APIC",

"id": "307011"

},

"newBusinessNumberOfInstalments": 12,

"renewalNumberOfInstalments": 11,

"newBusinessFlatRate": "10",

"newBusinessMinFlatRate": "5",

"newBusinessMaxFlatRate": "15",

"renewalFlatRate": "10",

"renewalMinFlatRate": "5",

"renewalMaxFlatRate": "15",

"code": "APIC01",

"providerName": "API Insurer",

"providerId": "307012",

"cancellationType": "Pro Rata - Cancellable",

"recourseLevel": "Recourse",

"type": "Personal",

"minLoanAmount": "100",

"maxLoanAmount": "10000",

"active": true,

"minimumCreditChargeActive": false,

"minimumCreditCharge": null,

"newBusinessMinimumDepositPercentage": "0",

"newBusinessMaximumDepositPercentage": "20",

"newBusinessMinimumDepositAmount": null,

"newBusinessMaximumDepositAmount": null,

"newBusinessDepositPercentageOfPremium": null,

"renewalMinimumDepositPercentage": "5",

"renewalMaximumDepositPercentage": "20",

"renewalMinimumDepositAmount": null,

"renewalMaximumDepositAmount": null,

"renewalDepositPercentageOfPremium": "15",

"product": {

"name": "Premium Finance Start Product",

"id": "107637"

}

},

"loanAdvance": 180.00,

"loanInterest": "18.00",

"deposit": 20.00,

"noInstallments": 11,

"flatRate": "10.0",

"firstInstalmentAmount": 18.0,

"regularInstalmentAmount": 18.0,

"apr": "23.70",

"customerId": null,

"feeCharges": [],

"softwareHouse": null,

"loanFees": 0,

"totalPayable": 198.00,

"minimumCreditChargeMet": true,

"preCheckResponse": null,

"preCheckResponseBreakdown": null,

"schedule": null,

"clientRef": null

}

💵 Step 3 - Create a Persist Quote Renewal

Also, because there are Credit Risk and Affordability (CRA) checks when applying for a loan, a question which is frequently asked is “Will the customer have a hard inquiry on their credit report?”

This step (Step 3) does the following: (1) Create a renewal quote. (2) Does a Soft inquiry, and returns the result of of the quote including the CRA. For more information on CRA, please see the FAQ section on this page.

The results of the persist renewal quote (including the CRA) allows you to decide whether to offer PremFina as a finance option. If the result of the soft inquiry indicates we may refer the loan, you may choose to not offer this option to the customer.

Another question that is frequently asked during a persist quote is “What is the data format, length and mandatory fields for the payload?” a

Click here to download a file that contains the list of mandatory fields, accepted values and data format: premfina_mandatory_fields_api.xlsx

A typical Renewal Business workflow is below i.e. to renew an existing agreement.

{{baseURL}}/v2/persist/quote/renewal/{{token}}

Persist Quote Renewal Payload Click to expand

{

"daysValid": "30",

"clientRef": null,

"getQuote": {

"schemeCode": "APIC01",

"deposit": "100",

"premium": "500",

"startDate": "2022-04-10"

},

"existingAgreementNumber": {{agreementNumber}},

"policies": [{

"startDate": "02-04-2022",

"cancellationType": "Pro Rata - Cancellable",

"reference": "PFTEST1",

"insurer": "API Insurer",

"coverType": "Car",

"premium": "500"

}],

"bankAccount": {

"sortCode": "000001",

"accountNumber": "00000001",

"accountName": "Returns Account",

"mandateConsent": "true"

}

}

Persist Quote Renewal Response Click to expand

{

"getQuote": {

"schemeCode": "APIC04",

"deposit": 20,

"premium": 201,

"flatRate": null,

"startDate": "2021-01-21"

},

"sharedXref": "API CRA Broker-8785063209274910",

"existingAgreementNumber": "000097517-02",

"agreementNumber": "000097517-02",

"createdOn": "2020-10-19",

"daysValid": 30,

"daysRemaining": 30,

"activated": null,

"activatedOn": null,

"scheme": {

"branchId": "5476010",

"classificationId": "100000",

"brandId": "107638",

"brandName": "Premium Finance Start Brand",

"hostCompany": {

"name": "PremFina Ltd"

},

"broker": {

"brokerOwnReference": null,

"source": "API CRA Broker"

},

"introducer": {

"name": "API CRA Broker",

"code": "APIC",

"id": "307011"

},

"newBusinessNumberOfInstalments": 12,

"renewalNumberOfInstalments": 12,

"newBusinessFlatRate": "10",

"newBusinessMinFlatRate": "0",

"newBusinessMaxFlatRate": "15",

"renewalFlatRate": "10",

"renewalMinFlatRate": "0",

"renewalMaxFlatRate": "15",

"code": "APIC04",

"providerName": "Aviva Plc",

"providerId": "105556",

"cancellationType": "Pro Rata - Cancellable",

"recourseLevel": "Recourse",

"type": "Commercial",

"minLoanAmount": "100",

"maxLoanAmount": "10000",

"active": true,

"minimumCreditChargeActive": false,

"minimumCreditCharge": null,

"newBusinessMinimumDepositPercentage": "0",

"newBusinessMaximumDepositPercentage": "0",

"newBusinessMinimumDepositAmount": null,

"newBusinessMaximumDepositAmount": null,

"newBusinessDepositPercentageOfPremium": "0",

"renewalMinimumDepositPercentage": "0",

"renewalMaximumDepositPercentage": "0",

"renewalMinimumDepositAmount": null,

"renewalMaximumDepositAmount": null,

"renewalDepositPercentageOfPremium": "0",

"product": {

"name": "Premium Finance Start Product",

"id": "107637"

}

},

"loanAdvance": 181.00,

"loanInterest": "18.10",

"deposit": 20.00,

"noInstallments": 12,

"flatRate": "10.0",

"firstInstalmentAmount": 16.61,

"regularInstalmentAmount": 16.59,

"apr": "21.41",

"customerId": 37598410,

"feeCharges": [],

"softwareHouse": null,

"loanFees": 0,

"totalPayable": 199.10,

"minimumCreditChargeMet": true,

"preCheckResponse": null,

"preCheckResponseBreakdown": null,

"schedule": [

{

"date": "2021-02-21",

"amount": 16.61,

"number": 1,

"status": "Due"

},

{

"date": "2021-03-21",

"amount": 16.59,

"number": 2,

"status": "Due"

},

{

"date": "2021-04-21",

"amount": 16.59,

"number": 3,

"status": "Due"

},

{

"date": "2021-05-21",

"amount": 16.59,

"number": 4,

"status": "Due"

},

{

"date": "2021-06-21",

"amount": 16.59,

"number": 5,

"status": "Due"

},

{

"date": "2021-07-21",

"amount": 16.59,

"number": 6,

"status": "Due"

},

{

"date": "2021-08-21",

"amount": 16.59,

"number": 7,

"status": "Due"

},

{

"date": "2021-09-21",

"amount": 16.59,

"number": 8,

"status": "Due"

},

{

"date": "2021-10-21",

"amount": 16.59,

"number": 9,

"status": "Due"

},

{

"date": "2021-11-21",

"amount": 16.59,

"number": 10,

"status": "Due"

},

{

"date": "2021-12-21",

"amount": 16.59,

"number": 11,

"status": "Due"

},

{

"date": "2022-01-21",

"amount": 16.59,

"number": 12,

"status": "Due"

}

],

"clientRef": null

}

🏦 Step 4 - Add Bank Details to a Persist Renewal Quote. This step is optional and only required if the quote was created without bank details.

When creating a renewal persistant quote in step 3, you have the option of adding the bank details within the perist/quote payload (see the Postman collections for sample payload). However, this exemplification breaks down the user journey experienced in a typical quote to buy where a quote is generated and if the client chooses to proceed with the monthly option, bank details are requested.

If you did not create the quote with bank details, you will need to add the bank details after collecting from the customer.

NOTE: You will need the sharedXref which was returned as part of the response for step 3 (/persist/quote/)

In order to update the quote with the bank details, use the endpoint below:

/update/pquote/{sharedXref}/{token}

Use the payload below in the body of your request with the test bank account details within it.

{

"sortCode": "000001",

"accountNumber": "00000001",

"accountName": "Test Account"

}

On production environment, PremFina uses an external bank checker service to validate the bank account details on various aspect.

Also, please note that PremFina does not require you to store the bank details of customers. This step (Step 4) is about you capturing the bank details and passing it to PremFina via the API. PremFina will use the bank details to set up a direct debit mandate which would be used to facilitate the monthly repayment of the loan.

The response for adding a bank details to a quote is similar to a persist quote. See example below.

Optional: Update Persist Quote Renewal Response Click to expand

200 - OK

/activate/quote/{sharedXref}/{token}

Activate Persist Quote Renewal Payload Click to expand

/activate/quote/{sharedXref}/{token}

Note: A persistent quote for the renewal must have been requested which would generate the sharedXred. Use the sharedXref of the persistent quote to activate the renewal quote.

If the renewal quote is successfully activated, then the response will be similar to the one below.

Activate Persist Quote Renewal Response Click to expand

{

"agreementNumber": "000085733",

"schedule": [

{

"date": "2020-10-26",

"amount": 40.72,

"number": 1,

"status": "Due"

},

{

"date": "2020-11-02",

"amount": 40.72,

"number": 2,

"status": "Due"

},

{

"date": "2020-12-02",

"amount": 40.72,

"number": 3,

"status": "Due"

},

{

"date": "2021-01-02",

"amount": 40.72,

"number": 4,

"status": "Due"

},

{

"date": "2021-02-02",

"amount": 40.72,

"number": 5,

"status": "Due"

},

{

"date": "2021-03-02",

"amount": 40.72,

"number": 6,

"status": "Due"

},

{

"date": "2021-04-02",

"amount": 40.72,

"number": 7,

"status": "Due"

},

{

"date": "2021-05-02",

"amount": 40.72,

"number": 8,

"status": "Due"

},

{

"date": "2021-06-02",

"amount": 40.72,

"number": 9,

"status": "Due"

},

{

"date": "2021-07-02",

"amount": 40.72,

"number": 10,

"status": "Due"

},

{

"date": "2021-08-02",

"amount": 40.72,

"number": 11,

"status": "Due"

}

]

}

If the renewal quote is referred, then the response will be similar to the one below. The referral will be reviewed by the credit team of PremFina.

Activate Persist Quote Renewal Response Click to expand

Proposal 000085733-01 Referred.

Before a Cancellation (Checking if an agreement is in a payment cycle)

Before cancelling an agreement, it might be helpful to determine if the agreement is in a payment cycle. In order to determine this, please use the endpoint below:

/get/bacsqueue/{agreementNumber}/{token}

The endpoint above accepts the agreement number and a tocken (derived from logging in).

Upon executing the BACS queue endpoint, a sample response for an agreement in payment cycle with transaction date not due returns a HTTP response code of “200 OK” and looks like the below:

Example 1: BACS Queue Response Click to expand

[

{

"amount": 72.50,

"statusDescription": "Not Transmitted",

"transactionCode": "ON",

"transactionDate": "2023-02-05",

"triggerDate": "2023-02-01"

}

]

Based on the BACS queue sample response above, please see below for what each field implies and their possible values.

What the fields mean:

- “statusDescription”: This shows the status of the BACS payment.

- “transactionDate”: This is the date on which payment will be debited from the Account.

- “triggerDate”: This is the date that an agreement goes into a payment cycle.

- “amount”: This is the amount of the transaction.

- “transactionCode”: This is the Bacs transaction code value.

Possible values for each field (and what it means):

-

“statusDescription”: Transmitted (transaction has been initiated), Not Transmitted (transaction has not been initiated), Suppressed (agreement’s payment cycle has been suppressed), Deleted (when agreement is NTUed, marked as completed/cancel), Cancelled (DD is cancelled), Caught up (when agreement is re-instated), Failed to send (can be due to invalid bank account)

-

“transactionDate”: A date value of YYYY-MM-DD format

-

“triggerDate”: A date value of YYYY-MM-DD format

-

“amount”: a decimal value of the transaction amount

-

“transactionCode”: ON (mandate registered), 17 (regular collection), 18 (DD representation), 99 (failure error/direct credit refund), OC (Cancel existing DDI), 01 (DD first collection), 19 (final DD collection), OS (Conversion instruction)

How to determine if an agreement is in a payment cycle (or not)

-

Overview: Everyday, at 0500 hours, a BACS job runs on PremFina’s system. Its main job is to curate agreements with a trigger date of the current day so that they can either be put in a BACS queue ready for collection or collected if they are already in the queue and the transaction date is the same day. We will skip bank holidays or weekends and consider the next working day when processing and placing agreements in a payment cycle.

-

Note: Please note that for a newly created transaction, the first BACS entry implies that the mandate is registered, and the transaction code is “ON” with an amount of 0.00. This entry should not be used to determine if an agreement is in or not in a payment cycle.

Example 2: BACS Queue Response (Common after 5 days after registration) Click to expand

{

"statusDescription": "Deleted",

"transactionDate": "2023-03-29",

"triggerDate": "2023-03-29",

"amount": 0.00,

"transactionCode": "0N"

}

Example 3: BACS Queue Response (Common after 5 days after registration) Click to expand

{

"statusDescription": "Transmitted",

"transactionDate": "2023-03-29",

"triggerDate": "2023-03-29",

"amount": 0.00,

"transactionCode": "0N"

}

Upon executing the BACS queue endpoint, a sample response for an agreement in payment cycle that is suppressed returns a HTTP response code of “200 OK” and looks like the below:

Example 4: BACS Queue Response Click to expand

[

{

"amount": 72.50,

"statusDescription": "Suppressed",

"transactionCode": "01",

"transactionDate": "2023-02-05",

"triggerDate": "2023-02-01"

}

]

-

Why the dates should be considered: As discussed during the meeting, there are scenarios that can make transaction code and statuses insufficient in determining if an agreement is in or not in a payment cycle. Also, the list of items in the BACS queue will keep growing for each collection cycle. Therefore, the date is required to identify the most recent item and also to determine if the date is within the range that should be considered before triggering a cancellation.

-

Scenario A - An agreement is in a payment cycle: To determine if an agreement is in a payment cycle,

- make a call to the endpoint -> read the item with the most recent <>

- If today’s date is any date from the trigger date (triggerDate) to the transaction date

(transactionDate) and/or less than 2 days after the transaction date, then the agreement is in

payment cycle.

- Use a logic that also considers statusDescription.

Example 5: Consider a check on a date: 07/July/2023 for a first collection. Click to expand

{

"statusDescription": "Transmitted",

"transactionDate": "2023-07-06",

"triggerDate": "2023-07-04",

"amount": 17.48,

"transactionCode": "01"

}

Note: Based on the above, even if the check is done on a day after the 6/July/2023, we need to consider +2 days from the transaction date…

Example 6: Another Example, for a scenario where a first collection was unsuccessful. Holiday scenario inclusive in this example. Click to expand

{