¶ Premium Finance designed with YOU in mind

Note: These apply for our Funded clients only! For any queries, please

clients@premfina.com

¶ New Business & Renewal to Broker

- Affordability & Credit Checks on every customer before acceptance

- AML & KYC checks on every customer before acceptance

- All failures will be notified on the portal - https://portal.premfina.com

- Unable to process a renewal if the agreement is in arrears (Renewal failures will be notified back to the broker)

- Unable to process if there are more than 3 defaults in the term of the loan (Renewal failures will be notified back to the broker)

- Applicant needs to be 18 or over on agreement creation date

- Agreement Start Date cannot exceed 45 calendar days from the agreement creation date

¶ Signing of Credit Agreements

- We require all credit agreements to be signed by the customer at the point of sale. This can be facilitated either by signing the paper copy and uploading it directly against the agreement through the broker portal or via our E-Sign email (unique link sent on agreement activation). Please note that if customer fails to sign and return their credit agreement, we may not be able to proceed with the loan advance.

Please note that the platform will continue sending automatic email & SMS reminders to the customer till the agreement is signed.

At present, the reminders are sent on the following days after agreement activation. (Assume agreement is activated on day 0)

| Notification Type | Days Reminder sent |

|---|---|

| Day 1, Day 4, Day 7, Day 10, Day 14 | |

| SMS | Day 7, Day 14 |

¶ Mid Term Adjustment

Business Rules For MTA Increase:

An MTA would be referred to the credit team if any of the following applies:

- Where the MTA quoted amount is less than the minimum MTA amount set on the scheme.

- Where the MTA quoted amount is greater than the maximum MTA amount set on the scheme.

- Where there are less than 3 instalments left in the payments.

- Where the first instalment of the agreement has not been cleared.

- Where there is stop category “Payment Plan’ applied to the loan.

Business Rules For MTA Decrease:

An MTA would be referred to the credit team if any of the following applies:

- Where the MTA quoted amount is less than the minimum MTA amount set on the scheme.

- Where the MTA quoted amount is greater than the maximum MTA amount set on the scheme.

- Where MTA decrease would result in a credit balance.

- Where the first instalment of the agreement has not been cleared.

- Where there are less than 3 instalments left in the payments.

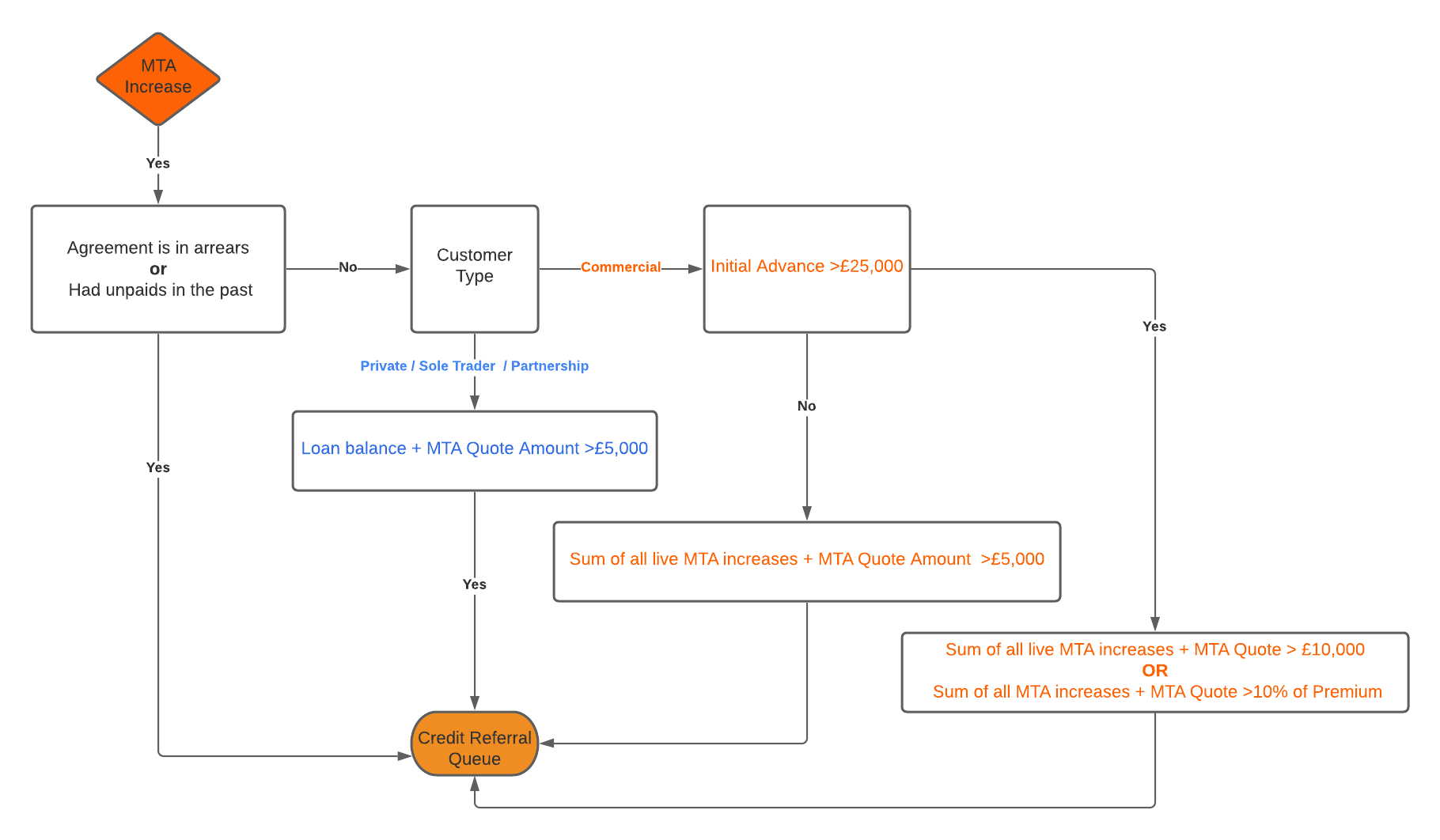

Credit Rules:

An MTA would be referred to the credit team if any of the following applies:

- Agreement is in arrears or has been unpaid in the past.

- Is a commercial client and the initial advance is greater than £25000 but the sum of all live MTA increases and MTA quote amount is greater than £10,000.

- Is a commercial client and the initial advance is greater than £25000 but the sum of all MTA increases and MTA quote amount is greater than 10% of the premium.

- Is a commercial client and the initial advance is less than £25000 but the sum of all live MTA increases and MTA quote amount is greater than £5,000.

- Is a private, sole trader or partnership and the loan balance plus MTA quote amount is greater than £5,000.

MTA Auto Referral Rules

¶ Collections

- 1st Collection in 7 Days ( 0% No deposit is taken)

- Subsequent Installments in line with policy start date.

- Catch up Payments will apply to backdated agreements.

¶ Cancellation / NTU

- Any agreement can be NTU’ed within 14 days, whether it has been funded or not.

- If over 14 days, we would agree to NTU an agreement if the agreement has not been funded

- If over 14 days and the agreement is funded, we would cancel via a RP.

¶ Fees…

Note: Please note that some of these may vary slightly depending on commercial agreeements

¶ Default Fee

- Personal Lines: £27.50

- Commercial Lines: £35.00

¶ Mid Term Adjustment Fee

- Personal Lines: £10.00

- Commercial Lines: £35.00

¶ Minimum Service Charge

Depending on the commercial agreement

¶ Facility Fees

Depending on the commercial agreement

¶ Broker Fees

These must be declared and needed for processing by our Credit Risk Teams

Note: For detailed operation on any fees, please click here.

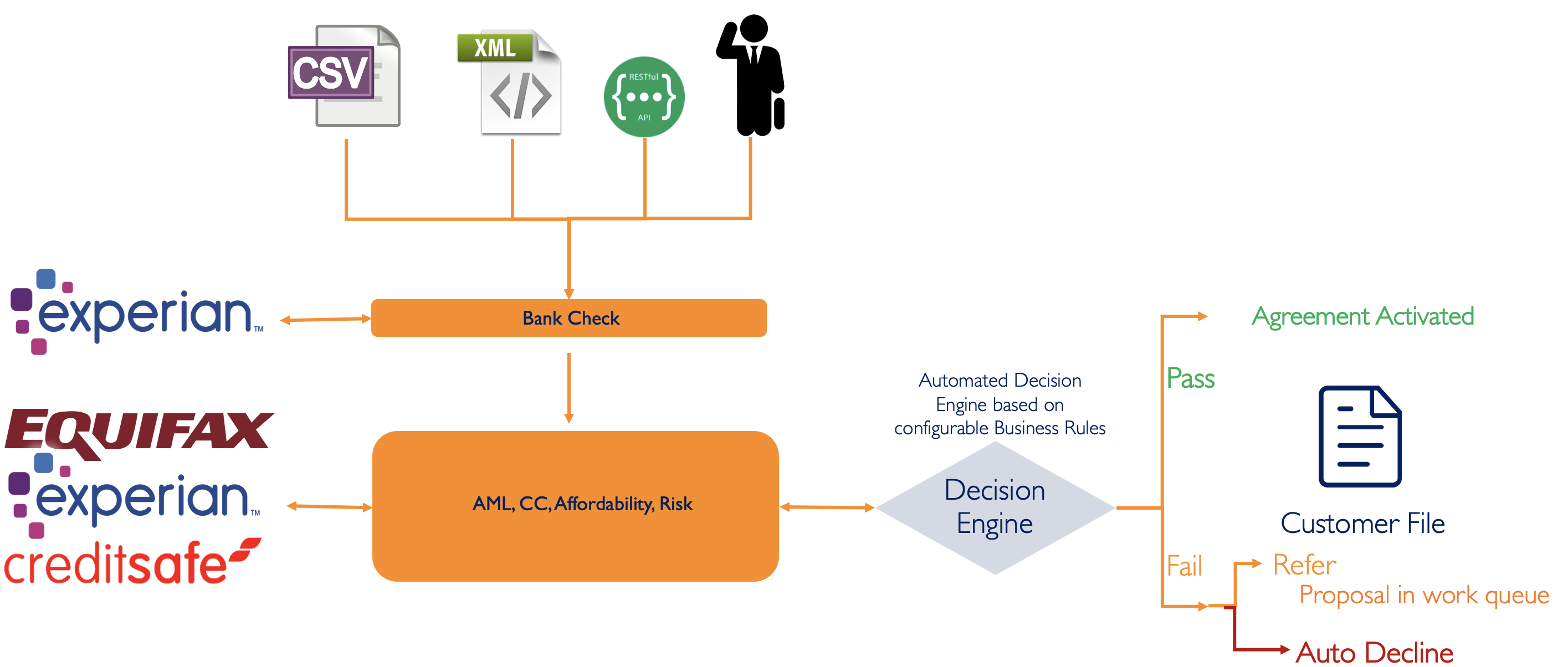

¶ Daily Processing

- CSV/XML Batch files are uploaded instantly by our Automated ETL service and processed by our data conversion services. The poller runs every couple of minutes to scan and poll the files.

- All files are processed 24x7 irrespective of bank holidays, weekends or out of hours within a maximum of 5 mins.

- Files to be reflected in Power BI (Data warehouse updated every 3 hours)

- All KYC, AML, Credit and Affordability are gerenally processed in real time as soon as the policy goes for activation/processed. However, if the automated decision engine refers for whatever reason (e.g. thresholds, business rules, credit/AML failures, etc), Team PremFina will complete affordability, AML and Credit Scoring (where applicable) within 24 hours.

- All Failures will be notified on the portal in real time; or responded back via API response. If required, an email will be sent requesting documents.

¶ Payments

- All regular payments will be collected automatically through BACS Direct Debit via our automated payments processing engine.

- End Customers can however use the PremFina payments section on the website to pay any of the following:

- Missed Payments (arrears payment including Fees if applicable)

- Full Settlement (the full outstanding balance)

- Partial Payment (any amount from £1 upto the full outstanding balance)

Note (for Partial Payment):

- The schedule updates to reflect that there was a partial payment made and the outstanding balance is then split across the remaining installments.

- If the next scheduled installment is within 5 working days, then this installment amount will NOT be altered. Instead the outstanding balance will be reduced after the inflight instalment; and split across all remaining installments.

- If there is any arrears payment (i.e. missed payments), the minimum amount for partial payment will be the arrears amount. Any extra amount will be used to deduct from the outstanding balance and reschdule the remaining balance amongst the remaining instalments.

- If the agreement is in “Debt”, one can make a partial payment anything from £1 upto the full outstanding balance.

- If the outstanding balance cannot be equally split across the remaining instalments, then it will be rounded down (by some pennies) before being split across the remaining installments.

- A reschedule letter is produced and sent to the customer showing the new schedule.

¶ Letter Suite & White labelling

The following below letters are branded to the broker / client showing the Broker Name and Address

Welcome Letter Initial letter on finance agreement activation

Renewal Letter Initial letter on finance Agreement renewal

Change of Address Letter confirming address change

Change of Bank details Letter confirming bank details change

DD Cancelled Letter informing custmer that the direct debit has been cancelled

Incorrect Bank Details Letter informing that the Bank details have not been possible to match

DD Mandate Letter and Mandate Letter confirming Direct Debit Mandate registration

DD unable to setup (AUDDIS) Letter informing customer failure to register DD

Early Settlement Quote Letter addressing early settlement

Change of Due Date Letter confirming due date change

Mid Term Adjustment Letter confirming mid term increase or decrease

Letters which have to provide PremFina Name and Address

Credit Agreement (SECCI) Standard European Consumer Credit Information

First stage default letters Arrears Missed payment, DD cancelled, DD problem

DD Mandate Cancelled (ADDACS) Letter informing direct debit has been cancelled by the customer

DD Problem Letter informing about a problem with the Direct Debit

Notice of termination letter Letter stating that PremFina will terminate insurance policy

Second stage default letter DD representation payment missed

¶ Decision Engine

For any risk or credit queries, please

creditrisk@premfina.com